It is shameful for India that even after two and one half decades of Economic reforms Indian Government invites FDI and FII to foreign companies to invest in dollars in India. Indian Government is desperate for dollars just for the sake of Debt Servicing ! Why not India concentrate on self reliance in the case of manufactured goods and self sufficiency in food grains? Indian manufacturing sector has become stagnant for the last two decades and showing negative growth for the last 3 years. Perhaps there is no agenda for addressing ailing manufacturing sector in the process of economic reforms.

Govts. are indulging in quick fix solutions. Every consumer good – Two wheelers, Cars, Cells, Pens, Paper, Cooking oil, food grains, .. every thing we use in India is imported (or manufactured in India under foreign Patent).

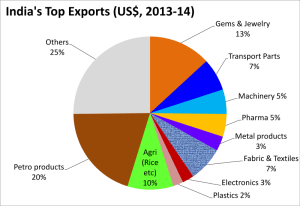

Outwardly India is showing off because of Cash Liquidity regularly effected since 1998 by periodical reduction in #CRR ( #CashReserveRatio ). For example, in 2000 with CRR reduction of 0.50 % Rs. 14,000 crore pumped into the economy. And, with a reduction of 0.25 % in CRR Rs. 17,000 crore is pumped in now (Sep,2012 ). So that about Rs. 40,000/- to 70,000/- crore are pumped into Indian economy by reducing CRR in order to enhance purchasing power of Indians. What for ? Apparently, to enable them to purchase imported goods!India exports little produced on its own.

Balance of trade between the US and India tilted in favour of the US after the so Called Reforms….See how Parliament has passed allowing FDI in retail market.! Obviously our Members of Parliament who have to discuss thread bear about the benefits or losses or implication while allowing FDI in retail simply Voted for the motion and passed it. Their freedom of speech is curtailed by the anti defection law.

Watch my Videos on YouTube channel

If they act or talk against their party whip they would lose their membership in Parliament. This make them rubber stamp MPs. Parliamentarians have no special rights as per our Constitution but only freedom of Speech based on principles of fundamental rights to the Citizens. Setting aside the prevailing laws MPs should have feel the compunction to do justice to their position and do their duty to save India and India’s Sovereignty.

It is good idea to curb waste expenditure by the Government of India. But the so called Corporate leaders I think cannot suggest better ways to regulate Government finances.

Your campaign tittle suggests that Tax is payed by mostly Corporate bodies.I don’t think People from Corporate bodies are competent to give suggestions about Government money management. It may be true that Corporate bodies pay more Tax to Central government.

Picture courtesy: M Tracy Hunter

(Actually this letter was written by me in Economic times in response to Governor or RBI’s comment on Pakistan’s banking system.) I do not know if the photo of D Subbarao, RBI Governor, is taken during the talk of this news or a file photo. But he is laughing sheepishly in the photo. Because he knows High interest regime is hindering progress of India in every front. This High interest regime is created and fostered by Babus like D Subbarao to the detriment Indian entrepreneurs. Islamic Banking on the other hand professes Zero interest rate on lending of money.

ALSO READ

- Fundamental rights

- Basic features of the Constitution

- Freedom Movement

- Nasadiya Sukta

- Atharva veda

- Jawaharlal Nehru 1889-1940

- Mahatma Gandhi 1869-1915

Whereas we Indian Hindus are on Christian way of lending under which no monetary transaction is recognized by Law unless it attracts interestâ. I think High interest regime is a major hurdle for India’s progress. In China interest rate varies between 2 to 5 %. In all Europe it varies between 5 to 8 %. Why India is reeling under 12 to 15 % interest rate ? Our High interest regime is unscientific even in economic sense. Why we should not shift to Zero interest regime of Islamic Banking from the present Christian Banking system ?

RBI Governor knows what is what . That is why D Subbarao is laughing sheepishly ! Islamic banking not consistent with existing laws: Reserve Bank“, dt. 9.5.13. “We got to see that Islamic Banking which does not allow charging interest or taking of interest is inconsistent with our existing laws…” RBI Governor D Subbarao said.Economic Times